can we take conventional insurance for islamic finance

Islamic Finance Development Report 2020 Page 2. Islamic finance is a system of financial activities that are consistent with Shariah Islamic law Major principles of Islamic Finance that differ from conventional finance are.

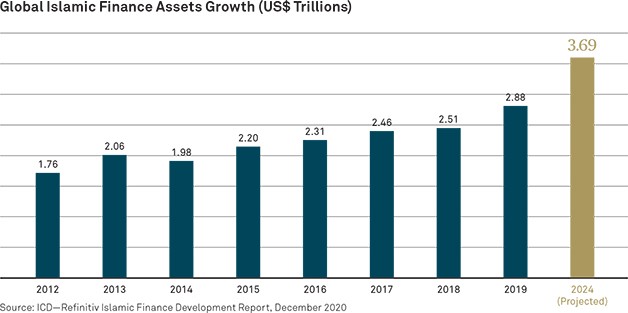

The Growing Global Appeal Of Islamic Finance

He added First thing we might see would be an increase in management fees as fund managers will want to charge more due to the expected market risk they will face while investment managers will want to put their money in ethical funds due to its performance in the last few years.

. The financing facility can be availed and utilized for financial needs such as education marriage medical expenses credit card loans settlements conventional loans settlements or meeting any other emergency needs in HALAL. The current global financial crisis is the result of the interest-based economies. Islamic Finance Development Report 2020 Page 8.

We can make insurance a not-for-profit activity provided we can ensure efficient. Some cases we can rectify for example in cases of Bay Fuduli ie. To find out how you can make your money go further read our guides to finance in Germany.

Whether takaful is significantly different from conventional insurance has been questioned. We strive to be a customer-driven company and our philosophy reflects in our course of operations. DIBPL is the first Islamic bank in Pakistan to offer a Sharia compliant Personal Financefacility based on the Islamic Finance concept of Musawamah.

A weekly educative column on Islamic banking and finance today Incident which set the course right for Islamic capital market. But as the brokers and various bourses mature and became more efficient the sequencing issues are largely mitigated and hard-structured into. At the inception of the.

The use of profit- and loss-sharing arrangements encourages the provision of financial support to productive enterprises that can increase output and generate jobs. Salary Transfer is not mandatory. Ban on interest Riba Ban on uncertainty Gharar.

The fourth annual Islamic Finance news poll was held in the year 2008 and State Bank of Pakistan was voted as at second number from the central banks all over the world that are taking interest in promoting Islamic banking. The bank can take advantage of its existing branch network to open so-called interest-free windows through which they can reach out to potential new clientele. By Geographic region Islamic Finance market can be segmented into Gulf Co-operation Council Saudi Arabia Kuwait UAE Qatar Bahrain and Oman the Middle East and.

It links credit expansion to the growth of the real economy by allowing credit primarily for. An Islamic loan follows the Islamic Financing Principle which avoids interest-based transactions Riba and instead introduces the concept of buying something on the borrowers behalf and selling it back to the borrower for a profit. Islamic finance can significantly contribute to economic development given its direct link to physical assets and the real economy.

With increasing maturity of Islamic finance the differences between Islamic and Conventional loan products have narrowed considerably. You can contact us and we can work on your behalf to arrange a best personal loan offer for you that will save your time and money. This subbranch of finance is a burgeoning field.

The emphasis on tangible assets ensures that the industry. In another article we explain about. Anyone not just Muslims can take up Islamic financing.

Select a subject. But lets take a closer look to see how else they differ. Islamic economist Mohammad Najatuallah Siddiqui writes that The form of organization chosen to take advantage of the law of large numbers does not change the reality.

The Islamic economic system is the collection of rules values and standards of conduct that organize economic life and establish relations of production in an Islamic society. The countries which were having very successful markets and. In series of interviews conducted in 2008 and 2010 with Pakistani banking professionals conventional and Islamic bankers Shariah banking advisors finance-using businessmen and management consultants economist Feisal Khan noted many Islamic bankers expressed cynicism over the difference or lack thereof between conventional and Islamic bank products.

A co-operative policy where funds are contributed by donations from participants. About Personal Loans If you decide that a personal loan is for you then it will make it possible to purchase what you need quickly. You can finance Insurance Accessories and VAT.

Retail investors will be pulling their capital from conventional banks to ethical funds. The Claims Team works with diligence and efficiency while the Operations Team including the Customer Services. These rules and standards are based on the Islamic order as recognized in the Koran and Sunna and the corpus of jurisprudence opus which was developed over the last 1400 years by thousands of.

Thus we can see that the Islamic financial system is capable of minimising the severity and frequency of financial crises by getting rid of the major weaknesses of the conventional system. Transactions involving uncertainty risk Ban of speculation gambling Maisir. Islamic Corporation for the Development of the Private Sector.

This could be an emergency. Emirates Islamic finance is available for a variety of Vehicle Brands for New Certified Pre-owned and used Vehicles. The pooled funds can be used to.

In fact the UK is the leading centre for Islamic finance in the west according to a report on Islamic finance trends by TheCityUK with five fully Sharia-compliant banks licensed here. An interest-free window is simply a window within a conventional bank through which customers can conduct business utilising only Shariah-compatible instruments. There is a large number of insurance products available in the market offered by different insurers.

In place of interest a profit rate is defined in the contract. Opening a bank account in Germany. Our aim is to enable Pakistani consumers to make well-informed financial decisions.

Like Conventional Financing profit rates can be fixed or based on a floating rate eg. Islamic finance can be seen as a unique form of socially responsible investment. At Adamjee Life we believe in exceptional customer service and take pride in our efficient provision of services that result in customer satisfaction.

But if your occupation is not deemed halal there could be difficulty in obtaining the loan. Is a co-ownership agreement where you and the bank own a separate share of the property. Our auto finance has a fully Sharia compliant Murabaha Structure.

When the term is over full ownership of the property will be transferred to you. Guide to banking in Germany This guide to banking in Germany looks at the German banking system and what banking options there are for expats in Germany. It introduces greater discipline into the financial system by requiring the financier to share in the risk.

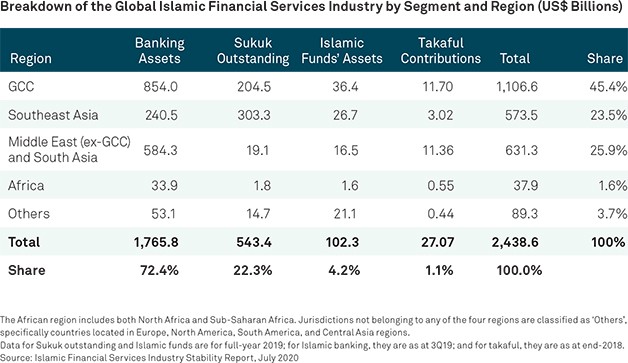

This is when the bank purchases the property you want to buy and leases it to you for a fixed term at an agreed monthly cost. We are on the subject of Sukuk default scenarios and I am explaining all possible events which can be envisaged in the run-up to the Sukuk maturity date and where the originator or obligor may not be able to walk the tightrope and resultantly may put. The Global Islamic Finance market can be segmented by Sector into Islamic Banking Islamic Insurance Takaful Other Islamic Financial Institutions OIFLs Islamic Bonds Sukuk and Islamic Funds.

You might have some idea about takaful insurance representing Islamic principles and that conventional policies are commercial products and you would be right. Purchase made by unauthorised agent due to sequencing breakage but some may require some drastic ratification even resulting in loss or charity payments. This is a Regular Murabaha product with subvention variant.

But rather than paying an annual equivalent rate of interest on savings - like most banks do - Islamic banks pay an Expected Profit Rate EPR so what savers earn depends on the profit the bank. Each time you make a repayment which is part.

Opportunities For Islamic Finance In The Uk Gov Uk

World Finance Islamic Finance Awards 2019 World Finance

The Growing Global Appeal Of Islamic Finance

Global Islamic Finance Market 2022 27 Industry Share Size Growth Mordor Intelligence

Islamic Finance Gears Up Finance Development December 2005

Screening Process Of Islamic Financial Product Development Download Scientific Diagram

Islamic Trade Finance Gets Crucial Industry Standard Global Trade Review Gtr

Basic Rules Of Islamic Finance C Download Scientific Diagram

0 Response to "can we take conventional insurance for islamic finance"

Post a Comment